20 Dec Scottish Budget 2024-2025

Yesterday, the Deputy First Minister and Finance Secretary of the Scottish Government, Shona Robison, delivered the 2024-2025 Budget. She has described it as the toughest new budget since the creation of the Scottish Parliament in 1999.

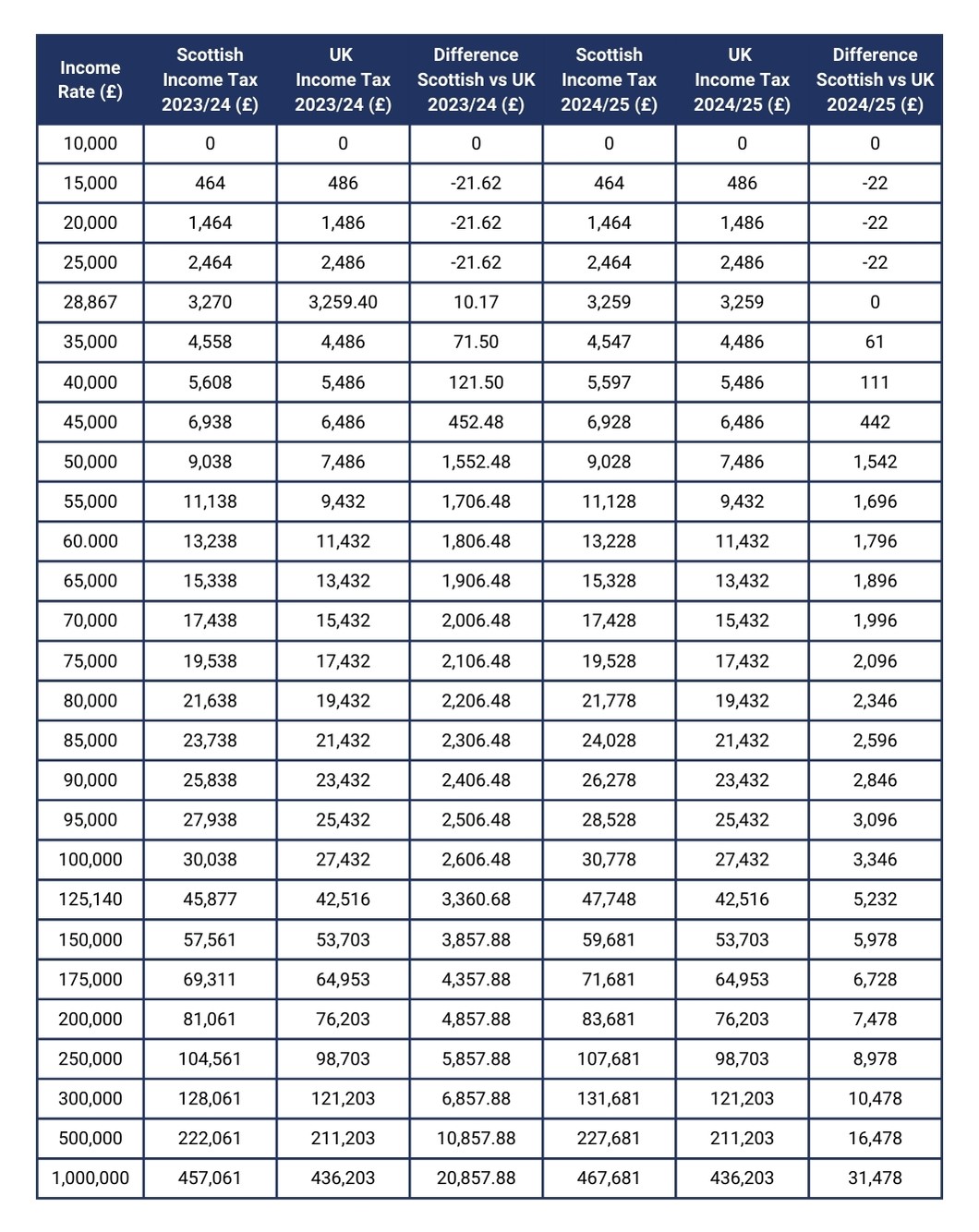

The Budget included the creation of a new top tier tax band, resulting in an income tax of 45% for those earning between £75,000-£125,140. The highest rate tax band has also been increased to 48%. These increases will affect approximately 100,000 Scots, and the Government forecasts that it will raise £82million.

Here are the key tax and business points from today’s announcement:

- A new 45% tax band will be created for those earning between £75,000 and £125,140.

- The top rate of tax, levied against those earning more than £125,000, will also rise by 1% next year to 48%.

- Starter, basic and intermediate rates frozen at 19%, 20%, 21% respectively.

- £43,663 threshold for higher band frozen instead of rising with inflation.

- Business premises valued below £51,000 will have their rates frozen.

- Hospitality businesses on the Scottish islands will be given 100% rates relief – up to the value of £110,000.

Here’s a breakdown of the 2023/24 and 2024/25 income tax rates: